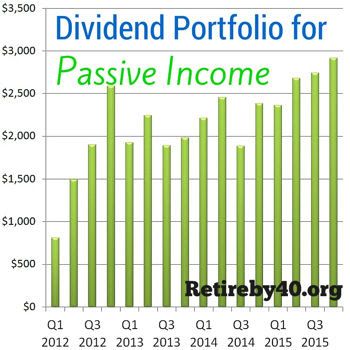

How you can build a passive income through a dividend portfolio

A dividend portfolio is a collection of stocks that regularly generate dividends. The portfolio is thus adapted for share dividends and the basic idea is that the dividends should function as passive income. But how to build a good dividend portfolio?? In this article, we outline the things that we believe are important to consider regarding this type of strategy.

Why invest in dividend stocks?

With today's low interest rates, it is no longer profitable to keep the money in a savings account at the bank. Especially considering that the Parliament's inflation target for the year is 2%. In simple terms, you can say this – If you get less return on your money than inflation, you have effectively lost money, precisely because an average good/service has become 2% more expensive during the year. If you get a return that matches or is higher than inflation, you have in fact made a profit. As we mentioned above, it is no longer profitable to keep your money in a savings account, as these offer at most around 1% interest on your savings, if not less. Many people then choose instead to put their capital on the stock market and invest in what are called dividend shares, i.e. shares in companies that choose to distribute part of their profits to their shareholders. These companies tend to be well-established and generate profits but often have little or no growth in their business. These companies choose to distribute their profits to shareholders because the money is not necessary for the company's day-to-day operations. Discount code if you want to order Aktieskolans e-book Order the Equity School e-book on how to invest in dividend stocks and get a 10% discount when you enter the discount code ”PENGAMASKIN10”. You can find more discount codes in our categories if you want to find other great deals.

How much is a good dividend?

An average dividend yield on the OMX30 is just under 4%, but a stable dividend stock can have somewhere between 3% and 8% in dividends. It is not at all uncommon for companies to have over 10% in dividends, but you should keep in mind that the dividend percentage is shown in relation to the current price and not the price at the time of the last dividend. Example: Let's say that the dividend for company X was 5% in relation to the price at the time of the dividend, but after a few months it stands at 10%. This does not mean that the next dividend will be 10%, it only means that the dividend was 10% of the current price. The share price has practically halved in value because the dividend is calculated in dividends in relation to the share price. Calculation example: Dividend in SEK / Share price = dividend percentage The AGM decides to distribute SEK 5. Today's price stands at SEK 100. A few months later, the price is at 50kr. On your stock market app, you see that the dividend is 10%. Then the app calculates like this = latest stock dividend / current stock price = dividend percentage. The app calculates as follows: 5 / 50 SEK = 10%. A high dividend may look appealing, but it can also be a warning sign that the company has been underperforming recently. This may mean that the company reduces its upcoming dividend, which in turn may lead to the share price falling even more.

What to do with the dividends?

The very best thing on the stock market is of course to reinvest the dividends so that you can buy new shares for that money – which in turn generates returns. This is called the interest-on-interest effect because the money grows exponentially. For many, the goal of a dividend portfolio is to have the payouts as a passive income to eventually live off them.